💼 TDS Salary Calculator

FY 2025–26 (AY 2026–27) | New Tax Regime

🧾 Standard Deduction: ₹75,000

💰 Section 87A Rebate: ₹60,000 (If income ≤ ₹12L)

🏥 Cess: 4% Health & Education

Enter your salary to calculate TDS

Updated for FY 2025–26 | Accurate New Tax Slabs | Auto Calculation Enabled

TDS Calculator Salary fy 2025-26

TDS Calculation on Salary for FY 2025-26 in Excel Free Download

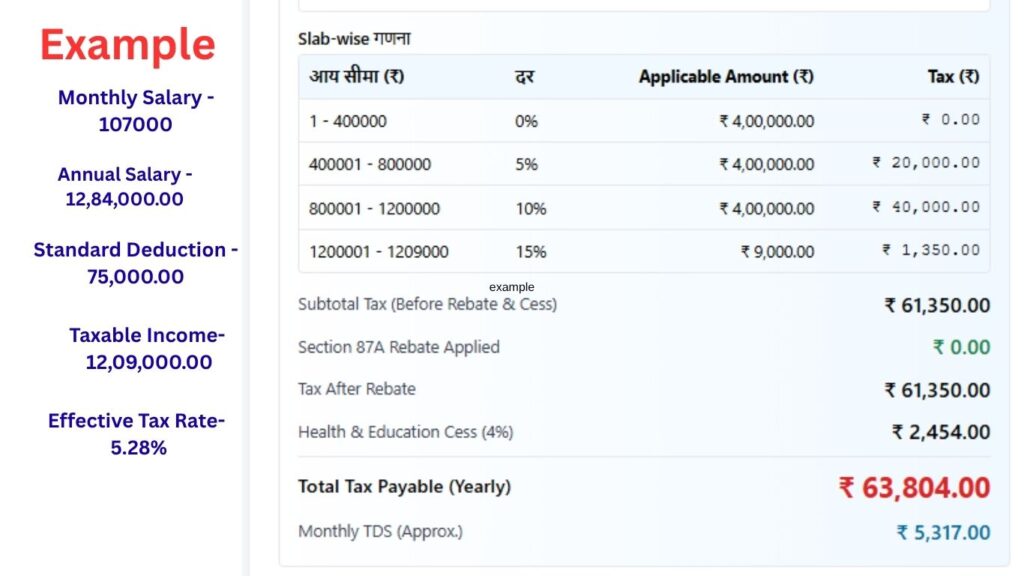

TDS calculation on salary for FY 2025-26 in excel helps employees and employers estimate monthly tax deduction with accuracy. A ready Excel sheet lets you enter salary income and automatically computes tax, surcharge, cess at 4 percent and total tax payable. It also shows the average tax rate so you can compare both systems side by side. The file includes old rates for 2025-26 and the new slab rates for FY 2025-26, makes it easy to decide the better option. This tool is simple to use and helps you plan tax saving while staying compliant.