GST Search by GSTIN

GST Search by PAN

GST Verification Online – GST Check Using GSTIN and PAN

GST verification is an important step for businesses, accountants and individuals who deal with GST registered suppliers or customers in India. With the help of simple online tools like GST search by GSTIN and GST search by PAN, anyone can easily perform a GST check and verify taxpayer details through the official GST portal.

The GSTIN search tool allow using a verify a registered taxpayer by entering a valid 15-digit GST identification number. One the GSTIN is entered and validated, the user is redirected to the official GST website where complete taxpayer information is available. This type of GST verification help confirm weathering GST number is active, cancelled, or suspended. It also reduces the risk of GST number being used in invoice.

GST Check Tool for GSTIN and PAN Verification

The GSTIN search by PAN future is useful when you want to check how many GST registrations are liked to a single PAN. By entering a valid PAN number, users can perform an GST check to see all GSTIN issued under that PAN across different states. This is especially helpful for auditors, tax consultant, and business owner managing multiple registration.

What Information Can Be Check Through GST Verification?

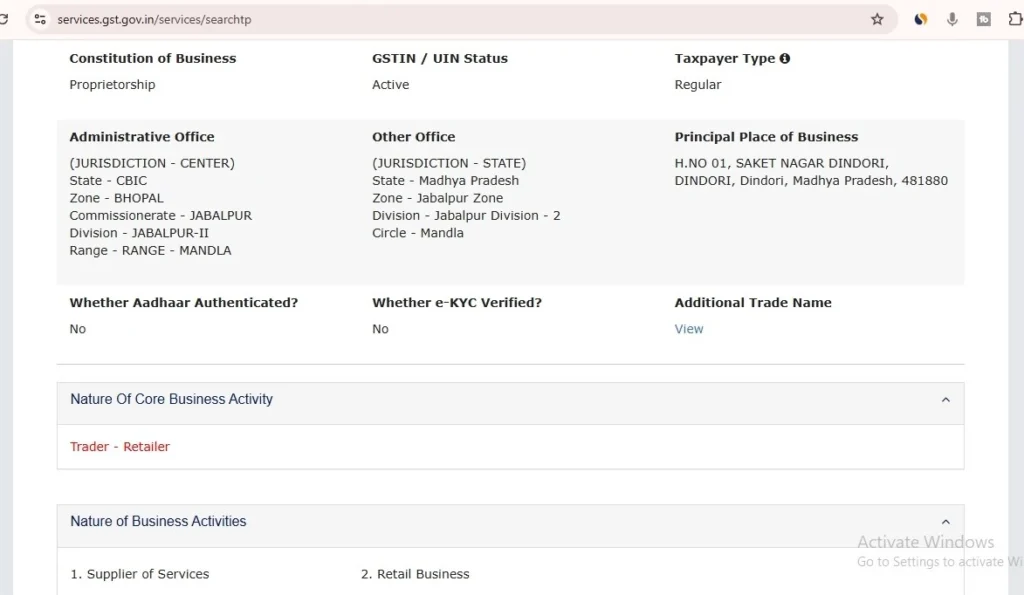

Using GST check tool, you can search a verify the following details:

- Legal name of business

- Trade name

- Effective Date of registration

- Constitution of business

- GST / UIN Status (active, cancelled, suspended)

- Type of tax payer (regular, composition, etc.)

- State and justification detail (administrative office, other office)

- Principal place of business

- Weather Aadhar authenticated

- Weather e-KYC verified

- Additional trade name

- Nature of Core Business Activity

- Nature of business activity

- Dealing in goods and service

- Show GSTIN filing table

- Show GSTIN return filing frequency

Regular GST verification insure compliance, avoid in correct ITC claims, and builds trust with vendors and customers. Before making payments or booking expenses, doing a GST check is a good accounting practice. In short, GST verification using GSTIN and PAN is fast, reliable and essential for accurate tax compliance in today’s digital GST system.